Anyone that is looking at buying a selling a property at the moment knows that the housing market is the busiest that it has been for many years. Every house that comes to the market either won’t let you view unless you are in a position to proceed, already has a block viewing or “open house” going ahead which is fully booked or is sold before it even goes on-line. As a First Time Buyer or someone in rented accommodation, this is difficult enough of a position to be in; but what if you are trying to sell one and buy another? How you do work through trying to find a property and being in that ‘proceedable position’ whilst not feeling the pressure of a buyer who is desperate to move into your home and pushing for you to move out?

At Lawler & Co we understand the pressure that this brings. We understand the difficulties that sellers have in trying to find properties whilst selling their own and we understand how difficult it is to be in line for properties when they become available. We understand this from a personal perspective as we currently have a family member who is going through the process and is having the exact same issues.

Catch 22

Traditionally, when looking at buying and selling, there has been a “catch 22” scenario that always plays through a sellers mind – do you sell first and then try to find somewhere or do you find somewhere and then try to sell? An “All or Nothing” scenario. With the market conditions as they are, this has been somewhat taken out of sellers hands and they are almost ‘forced’ into selling first and being in the best position when a property does become available. However, sellers also know that most properties will sell quickly, with their own being no exception. Here at Lawler & Co, we have come up with an innovate solution that a number of our clients are taking advantage of at the moment.

Market Ready

This position we have called “Being Market Ready” or “Low Key Marketing”.

This is for those clients who have decided that Lawler & Co are the Estate Agent that they know will do the best for them, but you are slightly more cautious about putting their property fully live on the internet because they know it will sell quickly. For these clients we will position them in “Low Key Marketing”.

This means the client will sign contracts and will instruct Lawler & Co to be their Agent of choice. We will take all of the photographs, complete the 360⁰ virtual tour, we will complete the floorplan and write the description in readiness. We will ask you to approve it all and then we wait. If the client would like us to contact certain, specific buyers then we will; we won’t if they don’t. If the client would like to accept viewings from buyers in specific positions, then we will organise for them to be done; if they don’t, then we won’t. Then we will wait and we will help the client to find their next home.

Whilst a client is on “Low Key Marketing”, they are, absolutely, on the market.

What are the advantages to the client?

There are many advantages to the client that allow the buying and selling process to run a little more at their pace. These include:

· One of the first clients to be informed when a new property comes to the market that would meet their purchasing criteria

· Finding a middle ground between the “All or Nothing Catch 22” scenario that we discussed earlier

· Allowing the client to pick and choose who views the property and when, or not having anyone view in the first instance

· Putting the client into a strong position to view properties where agents won’t allow viewings from buyers who are not on the market

· Ensuring that when the client DOES find a property that they like, and DOES want to start fully marketing and DOES want to go live on the internet; then with the flick of a switch and the press of a button, all of that can happen within an instance and their home will be launched through the websites and onto property portals saving valuable time and putting them in the strongest position to purchase the house of their dreams.

It works!

“Low Key Marketing” or “Being Market Ready” has worked incredibly well for a number of our clients who we have been successful in selling their own home quickly and to the right buyers, finding them their dream home and taking out some of the pressure that comes with the whole buying and selling process.

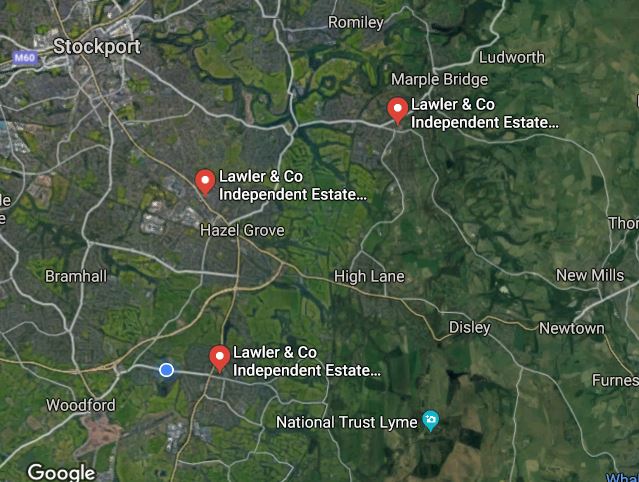

For more information on how this process could work for you, please contact any of the Lawler & Co offices

36 Stockport Road

Marple

Stockport

SK6 6AB

Tel: 0161 914 7620

marple@lawlerandcompany.co.uk

128 London Road

Hazel Grove

Stockport

SK7 4DJ

Tel: 0161 300 7144

hazelgrove@lawlerandcompany.co.uk

60 Park Lane

Poynton

Cheshire

SK12 1RE

Tel: 01625 448 001

poynton@lawlerandcompany.co.uk

Alan Cooper MARLA Hazel Grove Branch Manager talks about whether now is the right time to sell property portfolios.

We have been approached recently by a number of landlords enquiring about whether now is the right time to sell their portfolio of properties and whether there is a demand for properties with sitting tenants.

We have therefore looked at this and tried to give a balanced view.

Having dealt with rental properties for many years, we understand the pressures that landlords have been under in recent years. Legislation has been on the increase:

* The removal of tenants paying referencing fees;

* Mandatory EPC’s having to have a minimum of an ‘E’ rating;

* EICR Electrical reports now mandatory every 5 years;

* Installation of smoke and CO alarms;

* Changes to the “Right To Rent” legislation due to Brexit;

* Changes to Capital Gains Tax;

* Changes to “second home” stamp duty and

* Changes to the Digital Tax Regulations (MTD).

Whilst the EPC, EICR, and smoke/CO alarm changes (in conjunction with the Gas Safety Record) have certainly helped to ensure that rental properties are in a better, more efficient and safer condition, there is always an expense to be paid which (quite rightly), falls on the landlord.

The rental market through this period has remained strong and some of that expenditure has been absorbed due to the increase in rent.

However, there is more legislation being proposed and the “Renters Reform Bill” is due to be heard in parliament through 2022. If these do get passed it would be heralded as the most dramatic changes to tenant/landlord legislation since the the Landlord & Tenant Act in 1985. Some of the changes that are being proposed are:

* The scrapping of “no fault evictions” – in essence the scrapping of The Section 21 Notice and changes to the Section 8 notice with the process moving through the courts.

* Lifetime Deposits meaning tenants can move their deposit from one property to the next

* Rogue Landlords Database which can be accessed by tenants and agents

* Increasing the minimum EPC rating to “C” from the current “E”

* An amendment to the Dogs & Domestic Animals Accommodation Protection Bill which relates to tenants having pets at the property

These are due to be heard in Parliament this year but, at the time of writing, no date has been set.

Whilst the legislation has been changing, so have the rental figures that are being achieved and whilst the legislation can be seen as a “con” there are also “pro’s” to balance this out.

* You have a property that will continue to increase in value and can be sold

* You get a regular income on a monthly basis

So, is now the right time to sell your property portfolio?

House prices have never been higher and the demand for properties does not seem to be diminishing. We expect mortgage interest rates to continue to rise through this year and the phasing out of Mortgage Insurance and Tax Relief will continue to put additional pressure on landlords.

As a result, Lawler and Company have now established a section of our business to specifically cater for this section of the market. We can offer advice on whether to sell with a sitting tenant or whether to sell as an empty property; What sort of impact this has on the type of buyer that you are aiming the property at and how that impacts on the price that will be achieved; Whether to sell your portfolio as individual properties or to sell them as one portfolio; What method of sale will best suit your needs and we are able to offer special rates for landlords selling more than property.

Should you sell your rental portfolio? Our teams at Lawler & Co. are on call to help with this and any other queries you may have.

36 Stockport Road

Marple

Stockport

SK6 6AB

Tel: 0161 914 7620

marple@lawlerandcompany.co.uk

128 London Road

Hazel Grove

Stockport

SK7 4DJ

Tel: 0161 300 7144

hazelgrove@lawlerandcompany.co.uk

60 Park Lane

Poynton

Cheshire

SK12 1RE

Tel: 01625 448 001

poynton@lawlerandcompany.co.uk

Is the housing market slowing down? Will demand for properties slow down with the increases in cost of living and the impending Interest Rate Rise?

These are questions that we, as Estate Agents, get asked all of the time. Whilst we cannot predict the future, at this current time the answer to both of these questions is quite simply there are no signs that the market is going to slow down or that the interest rate rises will have an impact on buyers demands for properties.

All that we can say is that now is an excellent time to sell. The market continues to be strong. We have had more properties come to the market this January than we did last January. Buyers continue to want to purchase properties and demand is such that this normally means that there are “block viewings” and “best and final offers”. This does ensure that we are able to achieve the very best possible price, from the very best buyer for you.

However, this is also a great time to buy a property. The mortgage interest rates are still very low; house prices are continuing to increase which means equity being immediately accrued and the cost of borrowing is still less than the cost of renting. Being in the best possible position to purchase is really important. Having your mortgage approved and an Agreement in Principle available is essential to secure a property. Also being in a position to proceed is crucial. Being a First Time Buyer or in rented accommodation is always the beginning the process, but if you have a property to sell, then making sure that is under offer (SSTC) will ensure that the moment you find a property you can jump straight in and make an offer.

As you can see from the graphs below, taken directly from Rightmove, more people are choosing Lawler & Co as their preferred agent than any other local agent.

To find out why, book your valuation here.

The above data is derived purely from Righmove.co.uk’s internal statistics and advertisers on 01/02/2022. May be subject to specific geography or search criteria and is provided ‘as is’ for general interest only. Rightmove makes no warranty as to the data’s suitability for any purpose and accepts no liability for any action or inaction taken as a consequence of its use. For a full list of all competing agents contact marketing@rightmove.co.uk

The stamp duty holiday in England and Northern Ireland came to an end on 30th September 2021. Hundreds of thousands of house buyers have taken advantage of savings that have been on offer since the tax break was introduced in July 2020.

Since July 2021, the amount buyers have been able to save reduced. But homes priced at or below £250,000 buyers did not have to pay stamp duty.

And now it changes again. Are you aware of the new changes?

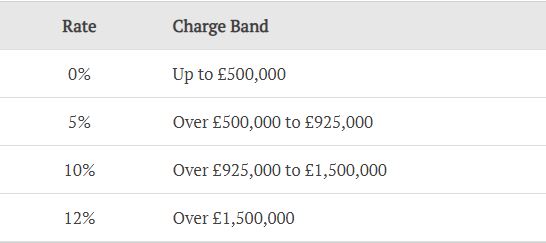

What are the stamp duty rates from 1st October?

From 1st October 2021, if you are buying a main home in England, you won’t need to pay any stamp duty on the portion of the property priced at or below £125,000.

If you’re buying a main home from 1st October 2021, you won’t pay any stamp duty on the portion of the property priced at or below £125,000. The next £125,000 to £250,000 you will pay 2% tax. Anything you spend between £250,001 and £925,000 will incur 5% tax, rising to 10% for properties priced between £925,001 to £1.5 million. If you spend above £1.5 million, you will pay 12 per cent in stamp duty tax, as below:

| Stamp Duty Land Tax rates from 1st October 2021 | SDLT rate |

|---|---|

| Up to £125,000 | Zero |

| The next £125,000 (the portion from £125,001 to £250,000) | 2% |

| The next £675,000 (the portion from £250,001 to £925,000) | 5% |

| The next £575,000 (the portion from £925,001 to £1.5 million) | 10% |

| The remaining amount (the portion above £1.5 million) | 12% |

If you’re buying a property, you can work out how much you’ll pay by using the Rightmove stamp duty calculator

Tax rates are higher for those buying a second home.

Will first-time buyers pay stamp duty tax?

Great news! First time buyers in England and Northern Ireland won’t pay any tax on homes priced at or below £300,000. 5% on a property priced between £300,001 and £500,000. However if your first home is priced above £500,000 you won’t be eligible for a saving.

Still not sure on how much stamp duty you will have to pay? Our teams at Lawler & Co. are on call to help with this and any other queries you may have.

36 Stockport Road

Marple

Stockport

SK6 6AB

Tel: 0161 914 7620

marple@lawlerandcompany.co.uk

128 London Road

Hazel Grove

Stockport

SK7 4DJ

Tel: 0161 300 7144

hazelgrove@lawlerandcompany.co.uk

60 Park Lane

Poynton

Cheshire

SK12 1RE

Tel: 01625 448 001

poynton@lawlerandcompany.co.uk

With the extend stamp duty holiday in England and Northern Ireland coming to an end on 30th June, what happens next?

Almost a year since this temporary reduction and it has meant no stamp duty tax to pay for first time buyers and home movers purchasing properties below £500,000 before end of June 2021.

From 1st July, a staggered return will be introduced to previous stamp duty rates. The nil – rate band will be lowered from £500,00 to £250,000 until 30th September. From 1st October 2021 it will return to £125,000.

The rate will also depend on if you’re a first-time buyer. From 1 July, first-time buyers will pay no stamp duty on properties worth up to £300,000, and a discounted rate on properties up to £500,000.

With the stamp duty tax thresholds on property purchases set to change, if you’re thinking of moving soon you can use the stamp duty calculator on rightmove to work out how much you’ll pay.

Thinking of selling your property and have questions that need answering about selling your property? Simply contact one of our branches for help.

This week from May 10th – 16th May 2021 is Mental Health Awareness Week. In the UK approximately 1 in 4 people will experience a mental health problem this year. This week aims to get people talking about their mental health and reduce the stigma that can stop people from asking for help.

Moving home as well as exciting can also be an extremely stressful time, with two thirds of people citing it as one of the most stressful times.

At Lawler & Co, we like offer advice and listen to our customers and relieve the stress and troubles that come with moving and here we give some tips on how to help take some of the stress away from the big move.

Organisation

Start preparing for the move as soon as you can. Declutter and pack as you go. Organise possessions that you will be taking and items that you can give to charity or are no longer needed. This will help you see how much stuff you have to take to your new home. Clothing that is not needed for current season can be packed and stored away ready for moving day. Don’t leave it for the final week.

Administration

Contact your utility companies to advise them of the move and your forwarding address. Internet and TV provider set up and ready to install for when you are in your new home. There is nothing worse than no Wifi for a week! If you have to relocate to a new GP and dentist, get registered in advance. Contact Royal Mail with at least a week’s notice to advise of you change of address and if you need to redirect your mail. Book in the removal company if you need assistance on the day! Try to book well in advance. If you aren’t changing your child’s school be sure to inform them of the change of address.

Time off

If you can, book annual leave from work before and after moving day so it’s not all crammed into one day or a weekend. The day of moving is so busy, leave it clear for you able to concentrate and not stress. Allow a couple of days after to settle in and give yourself time to sort out any little errands. Give yourself time to relax a little and enjoy your new surroundings. If you have little ones, ask a friend or loved one if they can help with childcare or petcare.

Home Comforts

Ensure to have any medications and must haves close to hand, packed in a easy accessible and safe place. Pack a few home favourites that will allow you to feel more settled in your new home and not have to dig to the back of the boxes piled high in the lounge. Favourites such as a cushion, throw, book, blanket. Anything that makes you feel at home. Don’t forget the kettle,teabags, milk and mugs!

Ask for help

Moving is a big job! Be sure to ask friends and loved ones if you are struggling on your own. It’s time consuming and they will be more than happy to help! Helping pack, load boxes, childcare or making refreshments are all great ways they can help.

Moving Budget

Moving house is a big expense and often unexpected expenses can arise. Be prepared for purchases and costs that you may inccur. Don’t forget the take away on the first day!

Familiarise

Take time to familiarise yourself in your new surroundings. Go out and see what local attractions there are on your doorstep. Here in the North West we are lucky to have some amazing National Trust parks, beautiful walks, canals. Get involved in any local community social media groups to see of any upcoming events. See what recreational facilities are available.

This year’s Mental Health Awareness week is all about Nature and how important it is is for our mental health.

Go out and explore, experience nature and #ConnectWithNature.

#mentalhealthweek2021 #estateagentsuk #movinghouse

Ready to put your home on the market but choosing the right estate agent is getting too overwhelming. What about an online agent? Should you pay for an upfront fee?Or do you approach a high street agent with an established physical presence in their local community, years of experience and unparalleled sales knowledge?

We’ve put together some reasons why Lawler and Co think a local high street estate agent is best, and in many cases provides better value for money than other offerings.

Ever heard the saying you get what you pay for? Well, when it comes to estate agents, the same principle applies. In fact, plumping for the cheapest upfront option might be a false economy because it may cost you money in the long run.

Why? With the right tools and unrivalled street-by-street knowledge of an area, nothing beats an established local agent. We don’t just sit back and let the sale take care of itself because we’ve already been paid, as is sometimes the case with DIY or very low-cost agents. We use our expertise and in depth local knowledge to achieve the highest possible sales amount for your property.

We have an up-to-date database of local buyers who are looking for specifics such as proximity to the local schools, transport links and leisure facilities. When a well-matched property is on our books, we’ll proactively approach people who we think would be interested in viewing it. Having access to this sort of local data can make all the difference when it comes to selling a property for the right price. Some one popping into one of our offices and having a chat can also offer this opportunity!

Viewings are one of the most crucial aspects of selling a property and while some people are comfortable in showing would-be buyers around their home, others have neither the time nor the inclination. True, some online estate agents do offer accompanied viewings but you’ll typically have to pay extra for the privilege. With all things currently restricted due to Covid19, we are now happy to provide 360 virtual tours of properties.

Check that your online agent is prepared to negotiate on your behalf: many don’t and will leave it up to you. You’ll have to decide if you’re absolutely comfortable in squeezing your buyer for the asking price you want or handling any last-minute paperwork problems.

Choosing to market your property through a local estate agent opens up a network of trusted community contacts and services – from builders and tradespeople to conveyancers and independent mortgage advisers, all of whom will be happy to meet you face-to-face. It also means you won’t have to hand over one of the most important decisions of your life to someone on the other side of a computer.

Upfront fees may seem tempting at first glance but check very carefully to see if there aren’t any hidden extras, all of which can soon mount up. Some agents charging extra for photography, ‘for sale’ boards and, as mentioned previously, viewings.

It’s said that not having a physical shop front and operating purely online is the future of estate agency. With over 20 years of experience in selling homes in Hazel Grove, Marple, Poynton and surrounding areas we know that having an accessible office that’s bright, welcoming and modern attracts footfall. We’re happy to be a focal point in our local community and having a physical location where people can drop by, chat to the team and find out what’s new on our books is incredibly important.

That doesn’t mean that we neglect our online presence, however. We advertise on many online platforms and like to also use Facebook, Instagram and Twitter. The difference is that, unlike a purely online estate agent, we don’t solely rely on these property portals to achieve sales. We like to think we offer the best of all worlds.

Our local knowledge together with our professional, dedicated sales team and marketing expertise means that our clients can feel confident and assured, you have chosen the correct estate agent to give you detailed accurate market advise on preparing your property for sale or rent for the best price

If you would like to speak to a member of our team and find out what your home is worth, please contact one of the offices below

36 Stockport Road

Marple

Stockport

SK6 6AB

Tel: 0161 914 7620

marple@lawlerandcompany.co.uk

128 London Road

Hazel Grove

Stockport

SK7 4DJ

Tel: 0161 300 7144

hazelgrove@lawlerandcompany.co.uk

60 Park Lane

Poynton

Cheshire

SK12 1RE

Tel: 01625 448 001

poynton@lawlerandcompany.co.uk

On the 8th July 2020, the government has today (8th July) unveiled a new stamp duty holiday that will run until 31st March next year. Read here for more details.

The impact has been striking but what does this mean for you?

Previously, stamp duty would have to be paid on homes sold for at least £125,000, or if a first-time buyer, on properties sold for more than £300,000.

Rishi Sunak has now raised this threshold to £500,000. Benefiting nine out of ten homebuyers paying no stamp duty at all, the average stamp duty bill falling by £4,500 and to help reinvigorate the post pandemic housing market.

Because the tax is paid after the sale of the home is finalised, even people who are midway through the process of buying a property will benefit from these changes. Buy-to-let investors and people in the market for a second home will also experience some relief due to the tax holiday, seeing a reduction to the stamp duty liability they would have otherwise have paid.

Not having to pay stamp duty means that all buyers will have more spare cash to help in the moving process, secure deposits and make renovations. Balancing a mortgage and decorating your dream home just got a little bit easier, making now the best time to dive into the property market.

With the team all now back at Lawler and Co, we are ready and waiting to answer all your queries, and help you find your perfect home.

Lawler and Co. win allAgents Awards 2019 in the Stockport area! Going above and beyond for their customers!

After the team being recognised in the allAgents Awards 2019 for their great customer service, we thought we would tell you all just how much we LOVE selling houses, and WHY!?

At Lawler & Co, we LOVE our jobs, we really do. We love to sell houses, we love to make our vendors happy and we love to find our buyers their dream homes.

We genuinely listen to our customers to understand their needs, whether they are selling or buying.

Looking after each sale and purchase personally, communication is key – you need to feel that you are in safe hands, and we want you to be happy!

Accompanying all viewings is standard, because we know sales. We know that potential buyers feel more comfortable asking questions with an agent, rather than a home owner. We know it works.

Taking absolute pride in marketing your property in the best possible way, with fantastic photographs and prominent branches throughout Stockport.

Our teams are all experienced and with a wealth of local knowledge can advise on anything from what day the bin collection is to what are the best local schools.

As a bespoke independent estate agency with prominent branches in Hazel Grove, Marple and Poynton we don’t believe in call centres to answer your calls. We want to offer the best personal experience from beginning to end.

Above all, we all thrive on doing a good job. When we see happy customers, we know we have done our job properly!

www.lawlerandcompany.co.uk