On the 8th July 2020, the government has today (8th July) unveiled a new stamp duty holiday that will run until 31st March next year. Read here for more details.

The impact has been striking but what does this mean for you?

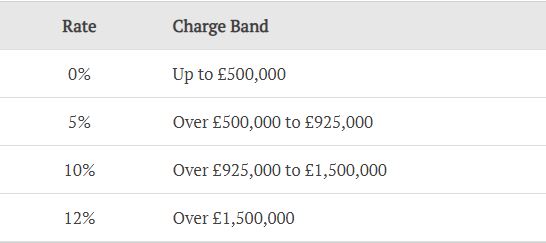

Previously, stamp duty would have to be paid on homes sold for at least £125,000, or if a first-time buyer, on properties sold for more than £300,000.

Rishi Sunak has now raised this threshold to £500,000. Benefiting nine out of ten homebuyers paying no stamp duty at all, the average stamp duty bill falling by £4,500 and to help reinvigorate the post pandemic housing market.

Because the tax is paid after the sale of the home is finalised, even people who are midway through the process of buying a property will benefit from these changes. Buy-to-let investors and people in the market for a second home will also experience some relief due to the tax holiday, seeing a reduction to the stamp duty liability they would have otherwise have paid.

Not having to pay stamp duty means that all buyers will have more spare cash to help in the moving process, secure deposits and make renovations. Balancing a mortgage and decorating your dream home just got a little bit easier, making now the best time to dive into the property market.

With the team all now back at Lawler and Co, we are ready and waiting to answer all your queries, and help you find your perfect home.