On 1st June 2019, the Tenant Fees Ban became law. Is this a good thing you ask?

This is a good thing, due to some Letting Agents charging inflated prices for tenant credit checks and check in/inventories. And under the new laws, there is almost a blanket ban on all tenant fees with a limit to the amount they can charge for a tenancy deposit, loss of keys, late rent fees and charges.

This new legislation will be mandatory for every assured shorthold tenancy in the private rented sector, and all new tenancies concluded after 1st June 2019. From 1st June 2020 these rules WILL apply for existing tenancies.

Confused by it all…..? Really the only things an agent or landlord can charge for are payments related to utilities and broadband, tenancy deposit, holding deposit, changes to agreement, TV Licence, Council Tax, Loss of Key, and a default fee for late payment. Here at Lawler and Co. we never did charge for a lot of that, and believe that the new rules are quite fair for all concerned.

So what are the 10 main points of these new laws?

- Viewings for prospective tenants will not be charged

- Letting agents and Landlords will not be allowed to charge for admin – all referencing, financial checks, admin and guarantors will have to be paid by the Landlord or agent. Renewal fees will still have to be paid for by tenant for tenancies that started before 1 June 2019.

- Landlords and Letting agents will be able to charge tenants for end of tenancy cleaning or check out fees, providing the tenancy agreement was agreed before 1 June 2019. Otherwise professional end of tenancy cleans will not be charged to the tenant except in extreme (including evidence) situations. This may be something that could cause fireworks!

- Agents will no longer be able to charge for expenses they incur using third parties, e.g. referencing or credit check agencies, gardening services or guarantor requests. Landlords will have to pay for any of these services.

- No changes will be made to the day, time and method of monthly/weekly rent payments.

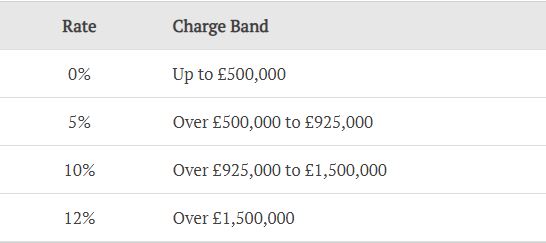

- Deposits capped– Landlords and agents will only be able to charge a maximum of 5 weeks rent, or if the annual rent of the property exceeds £50,000, 6 weeks rent.

- Holding fees will be limited to the equivalent of one weeks rent, and Agents will not be able to continue advertising a property if a tenant has reserved it with a holding fee. When the tenancy is confirmed, the fee needs to be repaid or after 15 days if the agreement doesn’t go through.

- Contract fee for amendments is capped at £50.00. If it costs the Agent more than £50.00. proof will have to be provided.

- Contract charges will be reduced if the tenant leaves before the end of the contract. No extra fees allowed just the amount they have to pay until the end of the tenancy.

- Restricted late payments. This applies to rent more than 14 days overdue, and it must be written into the contract from the get go. The charge for late payment is not to exceed 3% more than the Bank of England’s annual percentage rate (0.75% at time of writing) for each day the payment is owed.

A little known fact about the tenant fee ban is that all letting agents are legally obliged to advertise any and all permitted payments within their office premises and any online marketing, they must also state who their Client Money Protection (CMP) is with and what redress scheme(s) they are members of and regulated by.

The below is an example of how agents should be advertising in branch and online tenant permitted payments and CMP/Redress schemes;

Tenants Permitted Payments, Client Money Protection (CMP) & Agents Redress Schemes

As per the Tenant Fees Act 2019 Schedule 1 we charge tenants the following permitted payments (inclusive of VAT);

A refundable tenancy deposit (reserved for any damages or defaults on the part of the tenant) held in a government backed deposit scheme equal to one months rent.

Change of Tenant/Tenancy Agreement Amendments £50.00 plus any reasonable costs on the landlord or agents part.

Early Termination or Surrender of the tenancy when requested by the tenant any reasonable costs incurred by the landlord (ie lost rent or fees for a new tenancy).

Replacement of lost or stolen keys and or fobs within the boundary of the property at the cost of the relevant keys and or fobs plus reasonable costs on the agents part (£15per hour). Lock changes would be carried out at the tenants expense.

The landlords reasonable costs for the late or non payment of rent along with interest at 3% above the bank of England base rate.

Lawler and Company Lettings have client money protection (CMP) with The National Association of Estate Agents (NAEA).

Lawler and Company Lettings are currently regulated and a member of the Redress Scheme The Property Ombudsman (TPO) and Trading Standards for Property.

Lawler and Company Lettings are members of The Association of Residential Letting Agents (ARLA)

Lawler and Company Lettings currently register all managed clients deposits with The Deposit Protection Service (DPS)

Company Lets are still subject to a non refundable application fee of £300.00